Digital Voice of the Customer Due Diligence

This article is written for acquirers of Lower-Middle-Market (LMM) software companies — including Private Equity buyers, holding companies, and strategic acquirers.

TL;DR

- Public VOC (product reviews at scale) is a new diligence edge for LMM software deals.

- Scan your target and competitors in one pass; turn patterns into model and day‑1 priorities.

- SuiteCompete removes URL gymnastics—review links are pre‑wired into each competitor row.

Don’t let the seller’s narrative set your diligence agenda. Let their customers do it.

A new asymmetric advantage in LMM software M&A

Why this era is different

Ten years ago, diligence meant scrambling for reference calls. Today, your target and every competitor has already told you—publicly—what buyers love, hate, and switch for. That digital VOC trail (reviews at scale) turns anecdote into evidence and compresses your diligence cycle.

What’s changed practically is the cadence and quality of a “first pass.” In under an hour, you can scan 5–8 competitors, time‑bucket reviews by release, and see which complaints persist versus fade. Instead of a handful of curated references, you get hundreds of unprompted micro‑signals that cluster into themes: onboarding friction, reporting limits, support responsiveness, reliability, pricing confusion, and “we switched from X.”

The impact shows up immediately in your questions and model. A pattern like “setup takes weeks unless you buy services” becomes a management‑session lead‑off, a day‑1 onboarding initiative, and a 1–2 pt uplift to early‑cohort churn in your base case—before you’ve booked a single reference call.

Teams routinely reach a first pattern across 5–8 competitors in 30–60 minutes—enough to change what you ask in the first management session.

What changed

Review sites turned buyer experience into observable data. Even in LMM, there’s enough volume to read fit, friction, and differentiation. You also see trends over time. Example: a Q2 spike in “setup hell” after an implementation change—did sentiment normalize in Q3? Roles diverge too: admins often spot permission gaps before end‑users, which points to where friction really lives.

Signals to watch:

- Time clusters (complaints spiking in a quarter) versus background noise, or positive reviews spiking during a quarter (almost certainly initiated by the company requesting customer reviews)

- “Switched from/considered” language that defines the true battlefield

- Repeated “jobs to be done” that hint at adjacent use cases and expansion paths

- Integration and migration mentions that predict services load and time‑to‑value

Why it matters in LMM

You don’t have months or headcount. Public VOC tightens your IC narrative, reprioritizes your asks, and helps you avoid paying for product risk you can see in plain sight.

Speed and staffing constraints make a broad, light‑weight read more valuable than a deep, slow one. VOC helps you re‑order your diligence: lead with the issues customers shout about, then spend scarce analyst and founder time confirming or disproving those themes with data (tickets, cohorts, downgrade reasons).

It also sharpens the price. If reviews show chronic onboarding drag or packaging confusion, you can either re‑price the risk (churn, sales efficiency) or push a day‑1 fix and model the payback. Conversely, defensible strengths—“support saved the rollout,” “best reporting in class”—justify holding the line on a higher bid.

Outcomes we see in practice:

- Re‑ordering day‑1: top two customer‑voiced blockers become the first 6‑week sprints

- Model clarity: +/‑ 1–2 pt adjustments to early churn or realized ACV based on observed friction

- Cleaner IC story: direct quotes and cross‑platform patterns make the thesis legible and defensible

- Faster “no”: clear walk‑away triggers (e.g., reliability incidents + slow support) save cycles and fees

Where the digital VOC lives

The primary reservoirs

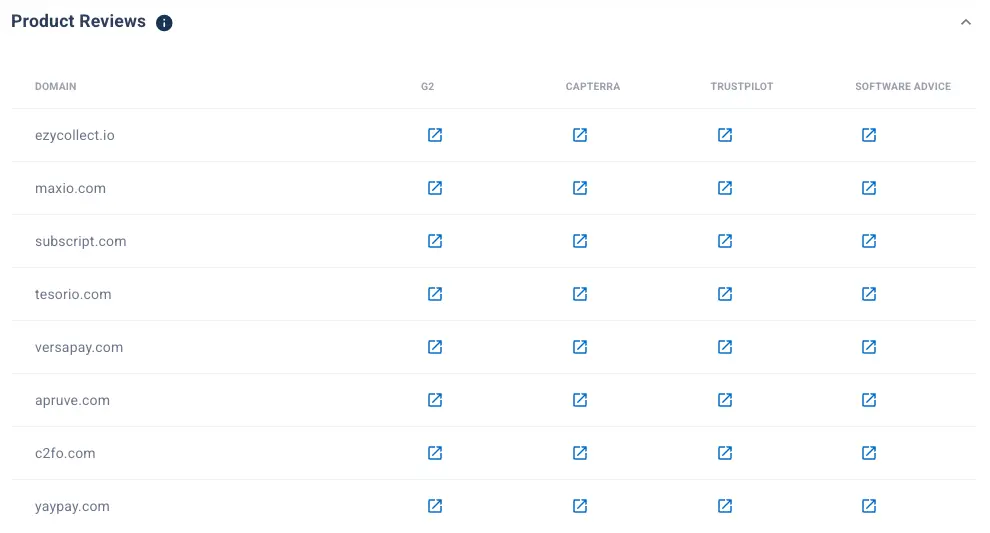

Buyer reviews concentrate across a handful of sites—G2, Capterra, Trustpilot, and Software Advice—each with different audience mix, review density, and noise profiles. Together, they cover most commercial and SMB software categories.

Fast access over heavy process

Instead of crafting queries, let your workflow bring reviews to you. SuiteCompete eliminates context‑switching: each competitor row carries pre‑wired access to G2/Capterra/Trustpilot/Software Advice, so you scan the entire set in one pass—and spend your time on patterns, not URLs. This keeps analysts in a pattern‑scan (not link‑chase) mode, which is why a first pass under an hour is common even with 6–8 competitors.

Right when you create a new project, SuiteCompete starts identifying and suggesting likely competitors for your target and automatically populates the competitive table—with review‑site links wired for each entrant—so you can begin scanning in seconds:

Why breadth beats depth (at first)

A quick read across multiple sites reduces single‑platform bias and helps separate category‑level noise from product‑specific issues. Depth comes next—after you’ve mapped themes.

In one category, we saw nine months of “setup hell” complaints cluster in Q2—absent from management’s narrative. That re‑priced risk and moved onboarding to day‑1 priorities.

Consequence: we added +2 pts to early‑cohort churn, scheduled a 6‑week onboarding sprint in the Day‑1 plan, and tightened the bid.

Guardrails and biases to watch

- Selection bias and recency effects: Extremes write more reviews; recent releases can distort sentiment. Do this: read medians and interquartile ranges per quarter; avoid one‑period snapshots.

- Astroturf and incentive artifacts: Look for copy/paste patterns, timing clusters, and over‑polished language. Do this: sample across platforms and ignore clusters tied to promotion spikes.

- Version and segment drift: Older reviews may speak to a previous product; SMB vs mid‑market experiences diverge. Do this: filter by version and company size; segment findings accordingly.

- Triangulate before concluding: Validate VOC themes with support ticket tags, NPS verbatims, and churn reasons. Do this: pick two internal corroborations per critical theme.

What reviews reveal that financials don’t

Fit and expansion vectors (model upside)

Look for repeated “jobs to be done” language and adjacent use cases customers stretch the product to cover. Why it matters: signals where expansion naturally lands—fuel for your post‑close growth plan. Action: add candidate vectors to post‑close plan with owners and 90‑day tests.

Time‑to‑value friction (churn risk)

Comments about setup, migration, and the “first week” show whether value lands fast or leaks through complexity. Why it matters: slow TTV shows up as early churn; adjust your retention assumptions. Action: raise first‑90‑day churn for cohorts where TTV complaints exceed your threshold.

“Setup took weeks—support was responsive but overwhelmed.”

Reliability/support (hidden burn and risk)

Outages, latency, and ticket responsiveness surface here before they appear in KPIs. Why it matters: outages increase CS load and discounting pressure; price for it or plan to fix it. Action: allocate Day‑1 CS capacity and set a reliability improvement OKR if incidents are clustered.

Pricing friction (downgrades and discounting)

“Nickel‑and‑dimed,” “locked behind a higher tier,” and “surprise limits” correlate with downgrade risk and sales efficiency drag. Why it matters: confusion stalls deals and lowers realized ACV. Action: lower realized ACV assumption where packaging confusion is prevalent.

“Feature I needed jumped two tiers mid‑contract.”

Switching triggers (who wins and why)

Mentions of “we switched from X” or “we considered Y” expose the real competitive set, switching triggers, and battlefield features. Why it matters: these are the levers for your win‑back plan—or your “walk” criteria. Action: add a win‑back hypothesis and define walk‑away conditions. Any new findings from this, you'll want to fast‑track into your Capabilities × Competitors grid:

Turning VOC into a diligence edge

Scan → Tag → Benchmark → Act

- Scan: skim across platforms to map recurring themes.

- Tag: apply a lightweight taxonomy (onboarding, support, reliability, reporting, pricing, fit).

- Benchmark: compare the target’s pattern to 3–5 rivals to find asymmetric strengths/liabilities.

- Act: convert top themes into management questions, data pulls, model sensitivities, and day‑1 priorities.

What each step looks like in practice:

- Tag themes; score frequency × severity: Rank what matters; keep only the top 3 themes per company to avoid noise.

- Benchmark against the competitor set: Compare the target to 3–5 named rivals to spot asymmetric strengths and chronic liabilities.

- Convert themes into hypotheses and questions: Turn patterns into management questions and data pulls (cohorts, ticket tags, downgrade reasons, win/loss). VOC guides the ask—it doesn’t replace it.

- Tie to the model and integration plan: Map severe themes to churn uplifts, sales efficiency assumptions, and day‑1 product/CS priorities. Positive themes inform cross‑sell and packaging moves.

A 30‑minute pass for deal teams

- 0–10 min: Create a new project (SuiteCompete will auto‑suggest competitors and populate the table), or paste your domains; click review links for 5–8 competitors; skim for recurring themes.

- 10–20 min: Tag 5–7 themes (fit, onboarding, reliability, pricing); capture 2 anonymized micro‑quotes.

- 20–25 min: Benchmark the target vs. competitors on top 3 themes (↑, ↓, ↔).

- 25–30 min: Draft 3 management questions + 2 model sensitivities + 1 Day‑1 action.

Note: In SuiteCompete, the review‑site links for each company are one click from the competitive table—no manual query crafting required. It keeps the focus on patterns and decisions rather than URL gymnastics.

From insight to deal advantage

Sharper thesis and cleaner price

Public VOC calibrates conviction. It can justify a higher bid for defensible strengths—or protect you from overpaying for a product with hidden friction.

A head start on post‑close value creation

Your first 90 days write themselves: fix the top two customer‑voiced blockers, double down on the most cited strengths, and communicate improvements back to the market where the voice lives.

Paste domains → get pre‑wired review links → scan patterns in 30 minutes. Open SuiteCompete, paste your domains, and scan patterns today—ask better questions tomorrow.