Confirmatory Diligence Framework: Validating Competitive Claims in M&A

Written for acquirers of Lower-Middle-Market (LMM) software companies: Private Equity, holding companies, and strategic buyers.

Executive Summary

Confirmatory diligence protects you from paying for strengths that only exist in the CIM / deck / data room, and improves your chances of understanding what post-close execution will be most powerful. In this post we'll look at the competitive analysis portion of that diligence stage. The highest‑return steps:

- Expand the seller’s curated disclosure of relevant competitors, revealing the real battlefield (direct, latent, legacy, upstarts).

- Broaden the feature/capability taxonomy to delineate between feature parity, fragile differentiation, and defensible advantage.

- Validate every claimed advantage with observable evidence tiers before it enters your valuation or growth model.

1. The Cost of a Shallow Competitive View

Seller-provided competitor lists are inevitably narrative devices. Natural (not malicious) bias filters out crowded adjacency, quiet legacy stickiness, and low-cost upstarts. As an acquirer, you have clear Risk & Mitigation dynamics to consider:

- Buyer Risk: You over-credit defensibility, justify a premium, and later discover pricing pressure or feature parity post-close.

- Mitigation: Seize the moment during confirmatory diligence to independently reconstruct the competitor universe, while valuation and deal structure are still flexible.

2. How Seller Framing Shapes Perception

Expect three inclusion patterns:

- Mandatory Incumbents – Leaving them out would damage credibility.

- Beatable / Weakening Players – Chosen to anchor your perception of target superiority.

- Adjacent Tools – Different ICPs that make the target’s focus look sharper.

What’s missing:

- Volume of Similarly Positioned Entrants – In one analysis we surfaced nearly fifty feature-parity players the deck ignored, by using the Jobs-to-be-Done technique to reveal competitors that had been overlooked.

- Lean Upstarts – Minimal revenue today, but low sunk cost + clean cap tables can enable disruptive pricing or vertical focus.

- Sticky Legacy Platforms – Entrants that the seller may dismiss as “non-factors”, underestimating the strategic power of entrenched integrations or contractual inertia.

As an acquirer, you have clear Risk & Mitigation dynamics to consider:

- Buyer Risk: Modeling growth against an artificially thinned battlefield, creating dubious growth expectations that percolate into everything from your IRR and MOIC assumptions, to your chosen CEO's compensation plan.

- Mitigation: Systematically expand categories during confirmatory diligence (feature-keyword crawling, integration ecosystem scans, job posting tech mentions, conference sponsor lists).

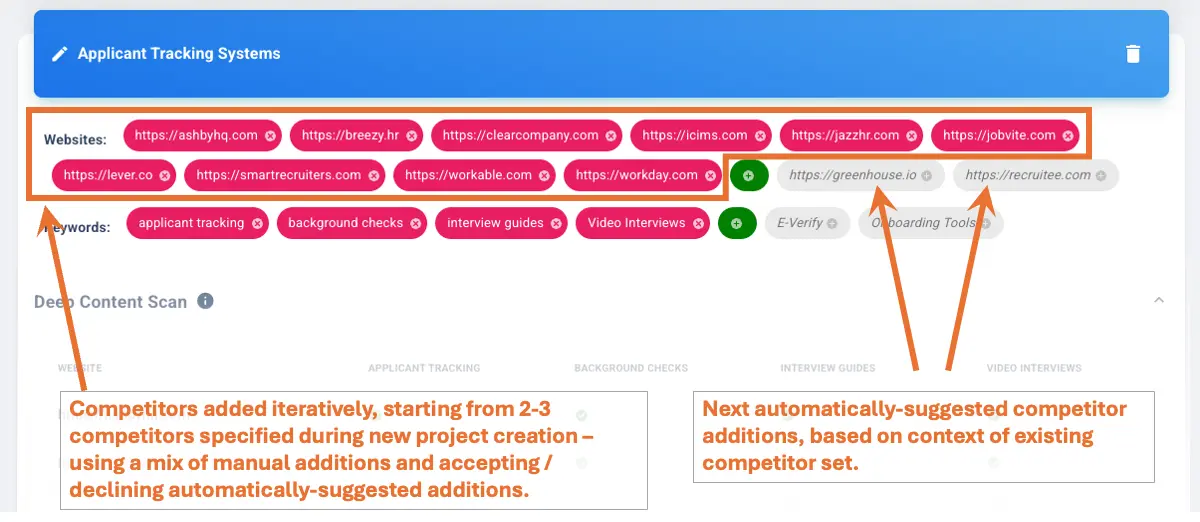

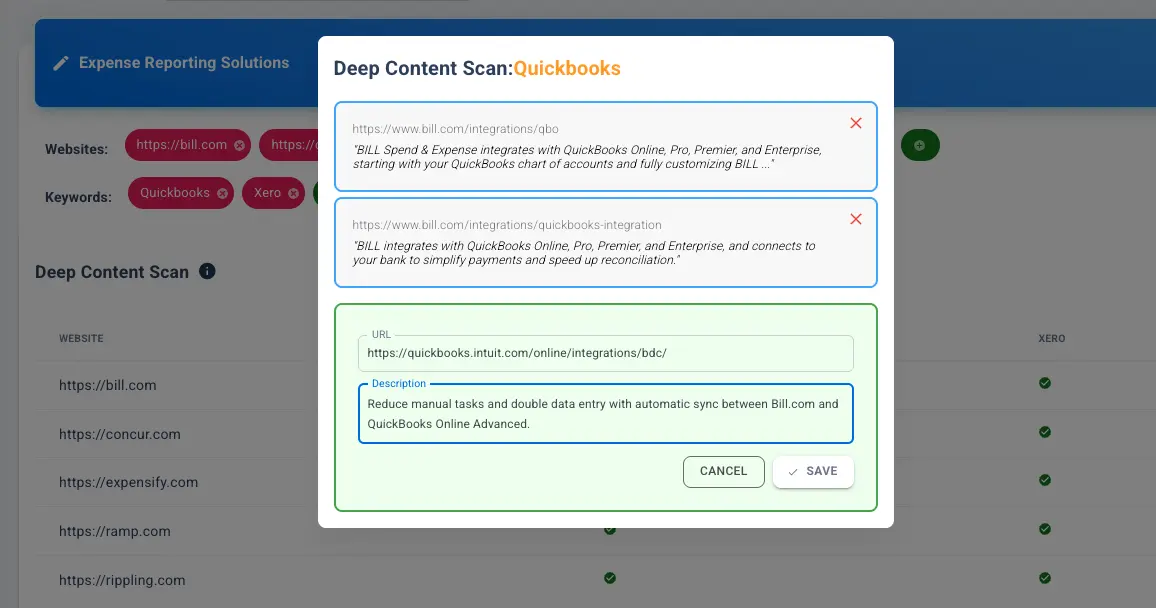

Need leverage? In SuiteCompete you seed with 2–3 competitors and receive suggested additions you can accept or decline:

3. Broadening the Capability Surface

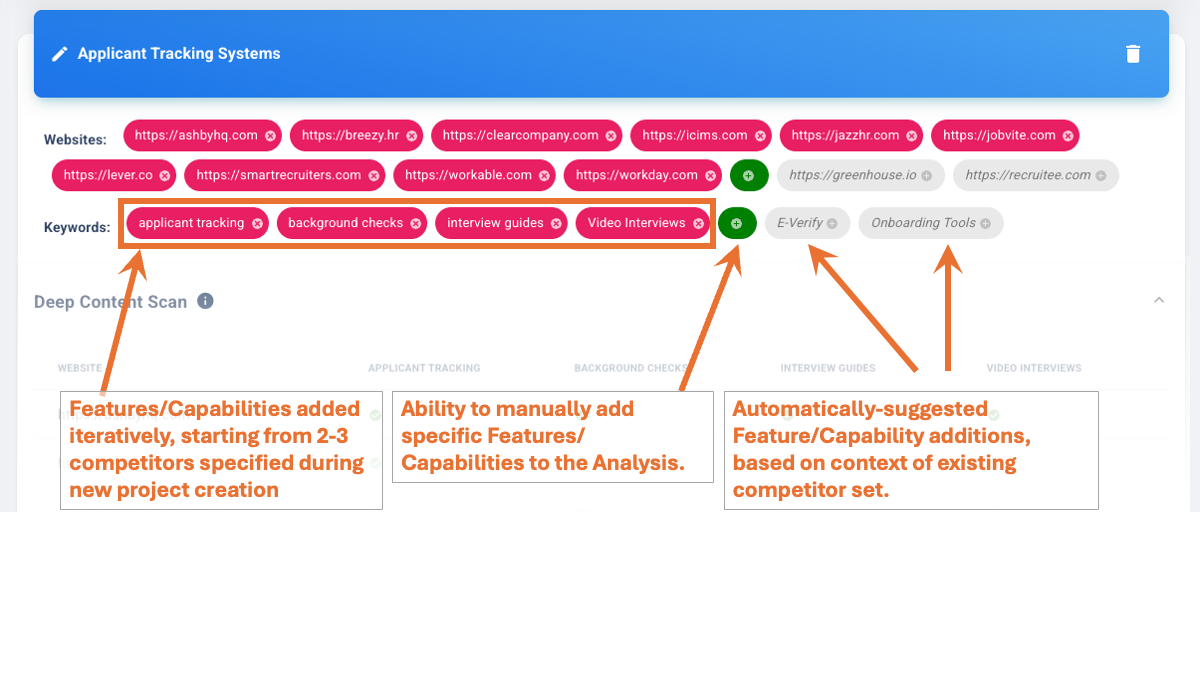

Starting from the seller’s feature list is fine; stopping there is costly. A narrow taxonomy hides silent parity. Expand into:

- Core transactional features

- Workflow extensions / automation layers

- Data enrichment / analytics depth

- Integration surface (CRMs, ERPs, payment, identity)

- Admin / governance / compliance controls

- Differentiators claimed verbally but not shown

Iterative expansion inside SuiteCompete mirrors competitor growth: seed → suggest → curate.

- Buyer Risk: Overvaluing “unique” capabilities that are actually table stakes.

- Mitigation: Use Harvey Balls to track your evaluation of relative strength of competitors on each feature/capability.

4. Building an Evidence Matrix (Competitors × Features)

Raw claims arrive dressed as Harvey balls. You need substantiation before they inform valuation or integration sequencing.

Common current-state (unspoken): junior team + late nights + ad hoc Google queries + manual screenshot archiving. Hidden labor yields fragile conclusions.

We built this to collapse the first 70% of effort:

Focus areas:

- Automated surface scan per (Competitor, Capability)

- Structured tabular summary for fast pattern extraction

- Click-through evidence artifacts (docs, UI captures, integration listings)

- Fully editable evidence dialog (add / remove / override) for analyst judgment

Evidence Quality Ladder

| Tier | Description | Reliability Impact |

|---|---|---|

| 0 | Marketing claim only | Extremely fragile |

| 1 | Claim + static screenshot | Low |

| 2 | Claim + interactive docs / API reference | Moderate |

| 3 | Claim + third-party integration listing / partner validation | High |

| 4 | Claim + customer-verifiable usage metric | Very high |

Prioritize elevating Tier 0–1 cells; they are where valuation inflation hides.

- Buyer Risk: Paying for unverified differentiation; misallocating integration resources post-close.

- Mitigation: Force every “moat” claim to earn ≥ Tier 2 before it influences price or strategic prioritization.

5. Before vs After Snapshot

| Dimension | Shallow Diligence | Expanded & Validated |

|---|---|---|

| Competitor Count | 6–10 curated | 35–50 mapped (+ latent) |

| Feature Taxonomy | 12–18 seller-selected | 60–90 categorized (core/diff/parity) |

| Evidence Coverage | 30% screenshots | 80%+ tiered validation |

| Analyst Hours | 80+ manual | 25–35 leveraged (automation + targeted deep dives) |

| Strategic Clarity | Narrative-dependent | Fact-based priority roadmap |

| Negotiation Leverage | Reactive | Proactive (data-backed challenge of claims) |

6. Converting Insight into Negotiation & Integration

Once the matrix is credible:

- Challenge inflated differentiation respectfully (anchors price corrections).

- Detect feature clusters that drive real stickiness (informs post-close retention focus).

- Sequence integration: shore up parity-threat gaps first; accelerate true differentiators second.

- Prepare management meeting questions tied to Tier 0/1 gaps (“Walk us through a live workflow where X drives measurable expansion”). During confirmatory due diligence, you can accelerate the evidence-gathering process using specialized ChatGPT prompt builders for commercial due diligence that generate structured research prompts for market sizing, pricing analysis, and competitive positioning.

7. Week 1 Checklist

- Extract seller competitor + feature lists.

- Run expansion pass (keywords, integrations, conferences, hiring signals).

- Categorize entrants (Direct / Latent / Legacy / Upstart).

- Define feature taxonomy & tag Core / Differentiator / Parity-Threat.

- Auto-generate initial matrix; elevate Tier 0–1 cells.

- Draft 5 gap-driven management questions.

- Summarize validated differentiation vs assumed.

8. Tool Assist (Optional Leverage)

SuiteCompete accelerates matrix construction by automating discovery, evidence surfacing, and iterative curation—the heavy lift before human judgment. Seed → Suggest → Verify → Challenge.

9. Closing: Competitive Clarity Compounds

Each verified cell lowers post-close surprise, sharpens integration sequencing, and fortifies your investment case. Build it before you own the assumptions. Want a guided expansion session? Visit SuiteCompete.com.